NEED TO KNOW

- Amazon disputes a report showing a 41% drop in Prime Day sales on Day 1, blaming consumer “wait-and-see” behavior.

- Fed Chair Jerome Powell reportedly told aides the numbers were “emotionally devastating” and considered retiring.

- The Federal Reserve has denied any official monetary ties to Prime Day, though Powell did place 47 items in his cart.

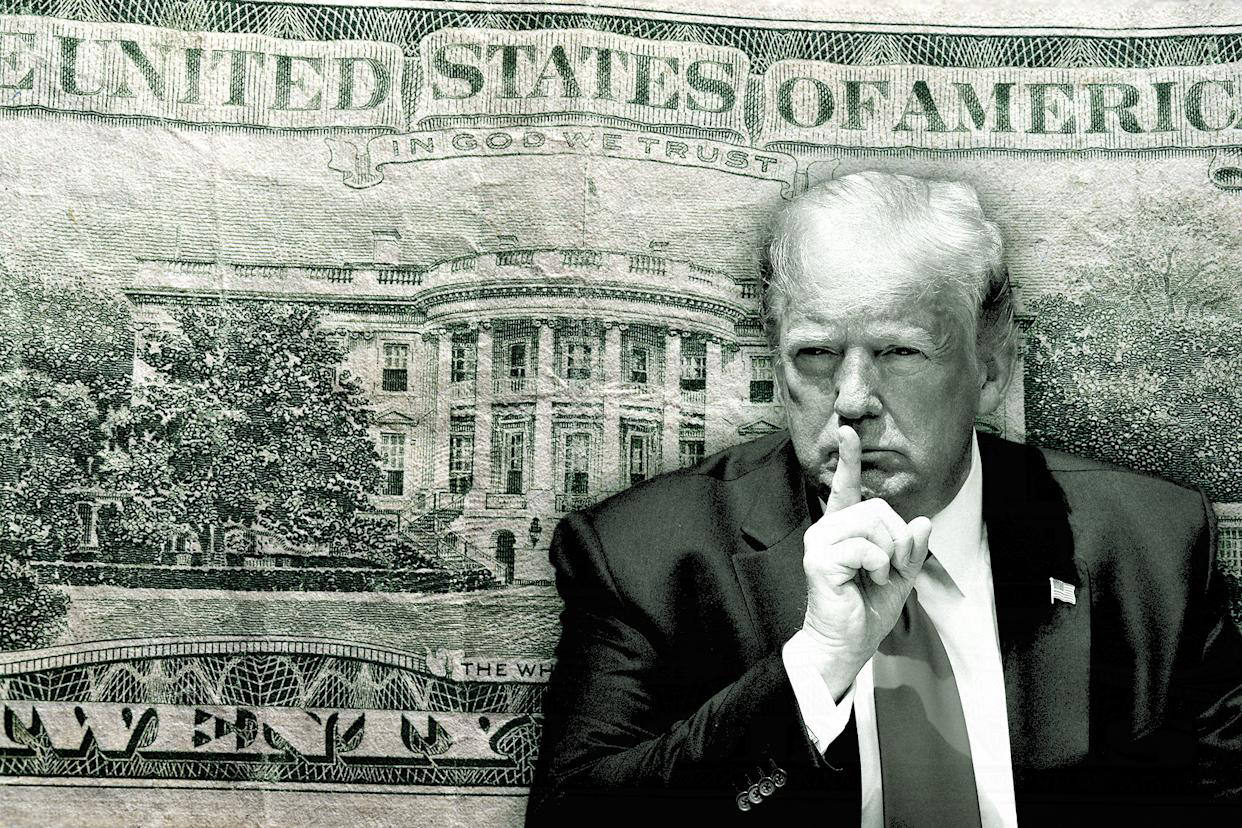

Powell Battles America’s Real Addiction: Discount Urgency

Federal Reserve Chair Jerome Powell held an emergency press conference Tuesday after early Prime Day sales reports showed a shocking 41% drop year-over-year. Though Amazon disputed the claim, Powell wasted no time blaming it for “undermining America’s confidence in stable pricing and spiritual fulfillment through moderation.”

“Inflation I can tame,” he said. “But I can’t raise rates fast enough to compete with 2-for-1 Ring doorbells and a $7 handheld blender.” He then reportedly attempted to return his own standing desk mid-speech, citing “mental clarity and free returns.”

Amazon, Fed Lock Horns Over Who Controls the Economy

Amazon insists shoppers are just pacing themselves through the extended four-day sale. “They’re not spending less,” said a spokesperson. “They’re just hate-scrolling more.” The company encouraged customers to remain calm, refresh often, and “ignore your financial advisor.”

Powell, meanwhile, questioned whether any data still matters. “We track CPI, PCE, NFP—but apparently all it takes is 60% off Ninja air fryers to erase twelve months of tightening.”

Is This the Last Hike? Or Just the Last Straw?

The Chair didn’t formally announce a resignation, but when asked about his future, he nodded toward a clearance-priced hammock on his laptop screen and whispered, “It’s calling me.” Markets rallied immediately, misinterpreting it as a signal for rate cuts.

I don’t know what inflation looks like anymore. I just know it has 5,000 five-star reviews and comes in teal.

Quote of the moment

We just wanted a simple air fryer, and now everything’s broken

Jerome Powell