NEED TO KNOW

- Fed’s quarter-point cut inspires record-setting levels of consumer shrugs

- Housing Market still locked tighter than your aunt’s Tupperware lids

- White House calls it “economic growth,” everyone else calls it “Tuesday”

Rate Cut Meets Reality

The Federal Reserve delivered a quarter-point rate cut last week, sparking celebration on Wall Street and total indifference everywhere else. While stock indexes briefly pretended to care, Americans responded by continuing to not buy homes, not switch jobs, and not move out of their parents’ basements. Economists described the reaction as “paralysis with confetti.”

Americans Still Stuck

Across the country, millions remain locked into low-rate mortgages like medieval serfs clinging to rent-controlled castles. New graduates stay trapped in their childhood bedrooms, while their résumés gather digital dust. A recent poll shows 63 percent of Americans believe it’s a bad time to find a job, while the other 37 percent already gave up and started selling homemade candles on Etsy.

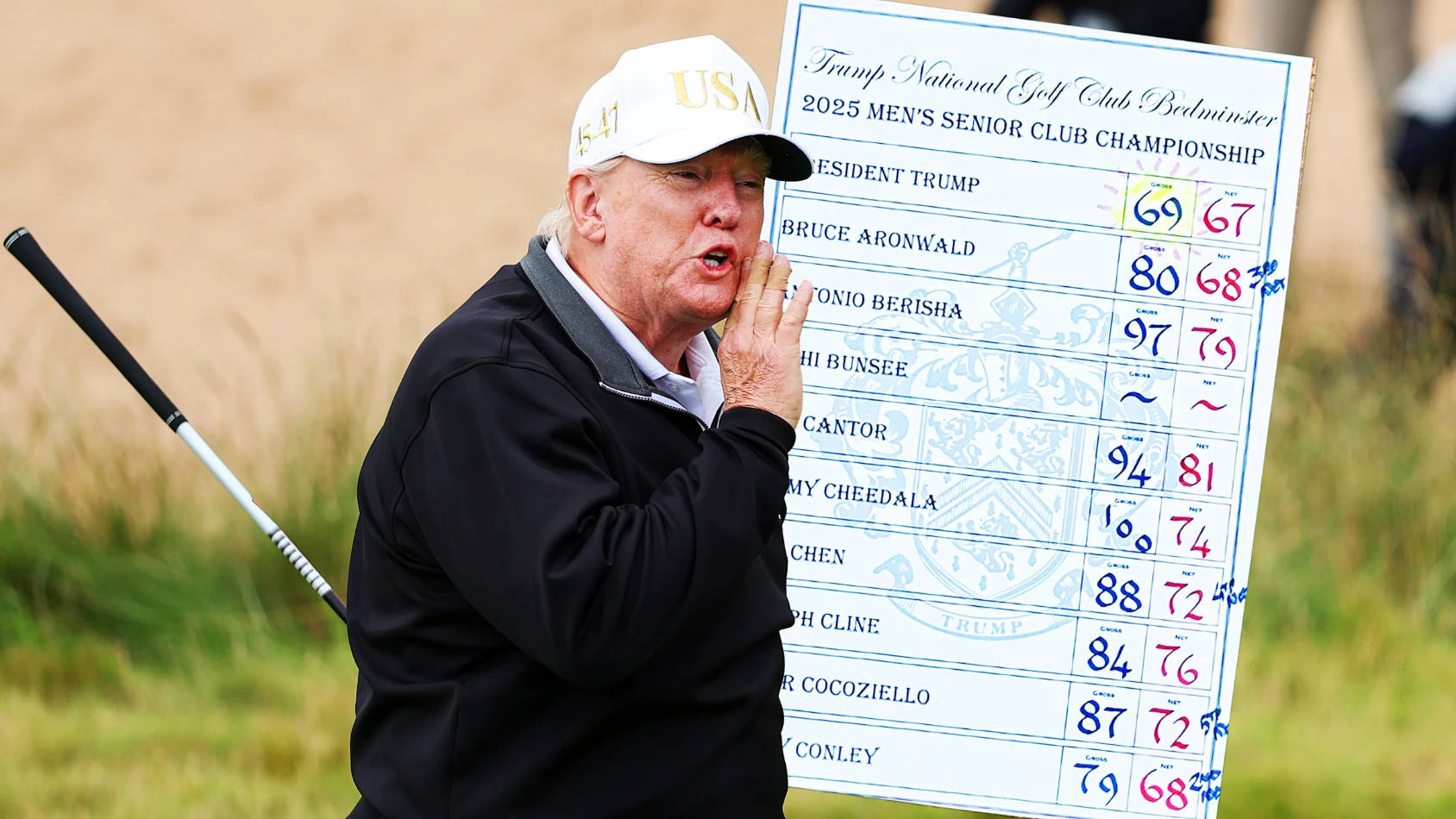

The White House Spin

Administration officials praised the Fed’s move, calling it proof that Trump’s economic agenda is “working perfectly.” In reality, home sales are still frozen, wages are flatter than airport pancakes, and job openings are scarcer than a working McDonald’s ice cream machine. Yet spokespeople insist the “best is yet to come,” which economists translate as “please clap.”

National Holiday Proposal

Some lawmakers now want to honor this era with a new holiday: Stuck Economy Day. Americans would celebrate by applying for jobs they’ll never get, scrolling through Zillow listings they’ll never afford, and making toasts with the cheapest boxed wine available. The Fed has promised more rate cuts, though critics note that the only thing really dropping is national morale.

We have built an economy where the dream is technically for sale, but the sign never comes down

Gordon Finley, American Institute for Despair Studies